OMBUDSMAN & GRIEVANCE REDRESSAL MECHANISM

Ombudsman & Grievance Redressal Mechanism

In the present competitive scenario, excellent customer service is an important tool for sustained business growth. Customer complaints are part of business life in any corporate entity. At ASK Financial Holdings Private Limited (ASK Finance, Company), customer service and satisfaction are our prime focus. We believe that providing prompt and efficient service is essential not only to attract new customers, but also to retain existing ones. In order to make the Company’s redressal mechanism more meaningful and effective, a structured system has been developed. This system would ensure that the redressal sought is just and fair and is within the given framework of rules and regulation.

Process for handling customer complaints/ grievances

Please voice your queries, feedback or complaints about our products or services through any of the below options

Call our Customer Service Helpline on +91-22-66520000

(Customer Care number functions from 10:00 A.M. to 05:30 P.M. from Monday to Friday excluding Public Holidays.)Email us at: grievanceaskfh@askgroup.in

Write to us at the below mentioned address:

Mr. Simit Mehta

Grievance Redressal Officer

ASK Financial Holdings Private Limited

Birla Aurora, Level 16,

Dr. Annie Besant Road,

Worli, Mumbai – 400030

Email: Simit.Mehta@askgroup.in

In case the complaint is not resolved within the given time or if you are not satisfied with the solution provided through above channel, you may approach the following:Level 1 Escalation

Mr. Dhruva Shah

Head Credit & Risk

Email: dhruva.shah@askgroup.in

You will receive a response within 5 working days. Please quote the reference of your earlier communication. In case the complaint is not resolved within the given time, or you are not satisfied with the solution provided through above channel, you may approach the following:

Level 2 Escalation

Mr. Dhiren Mehta

MD & CEO

Email: dhiren.mehta@askgroup.in

(between 10:00 am and 05:30 pm, from Monday to Friday except on public holidays)

You will receive a response within 3 working days. Please quote reference of your earlier communication in this regard.

Alternate Escalation

If you are still not satisfied with the resolution provided or if the complaint is not redressed within 30 days, you may file a complaint with RBI under the Reserve Bank - Integrated Ombudsman Scheme, 2021 through the following centralized channels:

Centralized RBI Complaint System:

Online Portal: | |

Toll-Free Helpline: | 14448 (Multi-language support) |

Timings: | 9:30 AM to 5:15 PM |

Physical Address: | Centralised Receipt and Processing Centre, Reserve Bank of India, 4th Floor, Sector 17, Chandigarh – 160017 |

Appellate Authority: | Executive Director, Consumer Education and Protection Department, RBI |

Email: | As provided on cms.rbi.org.in portal |

Reserve Bank - Integrated Ombudsman Scheme, 2021 (RB-IOS)

RBI vide notification dated November 12, 2021, integrated three ombudsman schemes into the 'Reserve Bank - Integrated Ombudsman Scheme, 2021' which superseded the erstwhile Ombudsman Scheme for NBFCs, 2018. This unified scheme provides a 'One Nation One Ombudsman' approach and is jurisdiction-neutral. This unified scheme provides a 'One Nation One Ombudsman' approach with jurisdiction-neutral complaint handling.

As an NBFC with asset size below ₹5,000 crores, the Company is not required to appoint an Internal Ombudsman but remains covered under the RB-IOS for external grievance redressal through RBI.

New Complaint Filing Methods:

Online: | |

Toll-Free Number: | 14448 (9:30 AM to 5:15 PM) in multiple languages

|

Email/Physical: | Centralised Receipt and Processing Centre, Reserve Bank of India, 4th Floor, Sector 17, Chandigarh – 160017 |

Thus, the Company has adopted the Ombudsman Scheme as provided below.

What are the grounds of complaints?

As per the Reserve Bank - Integrated Ombudsman Scheme, 2021, customers can file complaints on the following grounds:

- non-payment or inordinate delay in the payment of interest on deposits;

non-adherence to the Reserve Bank directives, if any, applicable to rate of interest on deposits;

non-repayment or inordinate delay in the repayment of deposits;

non-presentation or inordinate delay in the presentation of post-dated cheques provided by the customer;

failure to convey in writing, the amount of loan sanctioned along with terms and conditions including annualised rate of interest and method of application thereof;

failure or refusal to provide sanction letter/ terms and conditions of sanction in vernacular language or a language as understood by the borrower;

failure or refusal to provide adequate notice on proposed changes being made in sanctioned terms and conditions in vernacular language as understood by the borrower;

failure or inordinate delay in releasing the securities/ documents to the borrower on repayment of all dues;

levying of charges without adequate prior notice to the borrower/customer;

failure to provide legally enforceable built-in repossession clause in the contract/ loan agreement;

failure to ensure transparency in the contract/ loan agreement regarding (i) notice period before taking possession of security; (ii) circumstances under which the notice period can be waived; (iii) the procedure for taking possession of the security; (iv) provision of final chance to be given to the borrower for repayment of loan before the sale/ auction of the security; (v) the procedure for giving repossession to the borrower and (vi) the procedure for sale/ auction of the security;

non-observance of directions issued by Reserve Bank to the NBFCs;

non-adherence to any of the other provisions of Reserve Bank Guidelines on Fair Practices Code for NBFCs.

The Ombudsman may also deal with such other matter as may be specified by the Reserve Bank from time to time.

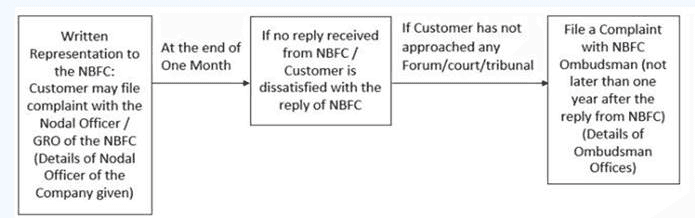

What is the procedure for filing the complaint before the NBFC Ombudsman?

Step 1: Internal Resolution (Mandatory) |

|

Step 2: RBI Ombudsman (If Internal Resolution Fails) |

|

Step 3: Appeal Process |

|

How does Ombudsman take decision?

Proceedings before Ombudsman are summary in nature

Promotes settlement through conciliation ----> If not reached, can issue Award/Order

Can a customer appeal, if not satisfied with decision of Ombudsman?

YES, If Ombudsman’s decision is appealable ----> Appellate Authority: Deputy Governor, RBI

Rejection of Complaint (by Ombudsman):

Please refer clause 16 of the RB-IOS, 2021, the RBI Ombudsman may reject a complaint at any stage, if the complaint: is non-maintainable under Clause 10 of the RB-IOS, 2021 such as;

is in the nature of offering suggestions or seeking guidance or explanation;

in the opinion of the Ombudsman there is no deficiency in service;

the compensation sought for the consequential loss is beyond the power of the Ombudsman to award as indicated in RB-IOS, 2021.

the complaint is not pursued by the complainant with reasonable diligence;

the complaint is without sufficient cause;

the complaint requires consideration of elaborate documentary and oral evidence and the proceedings before the Ombudsman are not appropriate for adjudication of such a complaint;

in the opinion of the Ombudsman there is no financial loss or damage, or inconvenience caused to the complainant.

Rejection of Complaint (by Deputy Ombudsman)

the complaint is non-maintainable under Clause 10 of the RB-IOS, 2021;

the complaint is in the nature of offering suggestions or seeking guidance or explanation

Address and Area of Operation of the Ombudsmen for NBFCs

| SN | Centre | Address of the Office of NBFC Ombudsman | Area of Operation |

|---|---|---|---|

| 1 | Chennai | C/o Reserve Bank of India Fort Glacis, Chennai 600 001 STD Code: 044 Telephone No: 25395964 Fax No: 25395488 Email: cms.nbfcochennai@rbi.org.in | Tamil Nadu, Andaman and Nicobar Islands, Karnataka, Andhra Pradesh, Telangana, Kerala, Union Territory of Lakshadweep, and Union Territory of Puducherry |

| 2 | Mumbai | C/o Reserve Bank of India RBI Byculla Office Building Opp. Mumbai Central Railway Station, Byculla, Mumbai-400 008 STD Code: 022 Telephone No: 2300 1280 Fax No: 23022024 Email: cms.nbfcomumbai@rbi.org.in | Maharashtra, Goa, Gujarat, Madhya Pradesh, Chhattisgarh, Union Territories of Dadra and Nagar Haveli, and Daman and Diu |

| 3 | New Delhi | C/o Reserve Bank of India Sansad Marg, New Delhi -110001 STD Code: 011 Telephone No: 23724856 Fax No: 23725218-19 Email: cms.nbfconewdelhi@rbi.org.in | Delhi, Uttar Pradesh, Uttarakhand, Haryana, Punjab, Union Territory of Chandigarh, Himachal Pradesh, Rajasthan, and the State of Jammu and Kashmir |

| 4 | Kolkata | C/o Reserve Bank of India 15 Netaji Subhash Road, Kolkata-700 001 STD Code: 033 Telephone No: 22304982 Fax No: 22305899 Email: cms.nbfcokolkata@rbi.org.in | West Bengal, Sikkim, Odisha, Assam, Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Tripura, Bihar, and Jharkhand |

NOTE: This is an Alternate Dispute Resolution mechanism. The customer is at liberty to approach any other court/forum/authority for the redressal at any stage. For further details of the Scheme, please visit www.rbi.org.in. We value your opinions and hope to serve you better.